Knowing what business finance tasks need to be done and the different financial professionals available to help, will give you the confidence to assemble a team that increases your freedom and powers your business’ success.

The 7 Finance Tasks Your Business Needs Done

No matter the size or type of your business, there are 7 financial tasks that every business should be doing:

- Set accounting policies: You need to identify what accounting rules relate to you and how best to apply them in your business. This is everything from general rules (like which meals are 50% or 100% deductible) to industry-specific rules (like when to recognize subscription revenue).

- Design finance workflows: You need to select good finance apps, determine how to effectively use them, establish standard steps to record transactions, ensure there’s adequate safeguards, have a method to store support documents, and then update the design as your business and technology evolves.

- Record day-to-day transactions: You need to create invoices, record bills, apply payments, save support documents, run payroll, and other day-to-day tasks to keep your business running.

- Monitor accuracy: Recording transactions is one thing, but you’ll also want to periodically check against statements, scan through activity for mis-classifications, and look at the big picture to identify missing pieces or parts out of place.

- Interpret performance: Accurate numbers are only useful if you evaluate overall performance, track whether specific initiatives are working, and decide what adjustments to make as a result.

- Report: You’ll need to report results to the government on your taxes, possibly prepare reports for Board meetings, even send numbers to the bank for loan covenants, or for liability insurance.

- Forecast: Seeing where your business’ finances are headed, confirming if expected cash flows actually work, and running what-if scenarios for various new plans are critical for every business.

Making sure these 7 tasks are covered means your business finances will be operating like a well-oiled machine that’s helping bring your vision to life.

Financial Professionals Available to Help

The most successful entrepreneurs recognize they’re more effective by leveraging a team to solve their problems. People you might turn to when building a team for your business’ finances are:

- Bookkeepers: A bookkeeper’s main function is to record day-to-day transactions to keep the books up-to-date. They can vary in education and specialty, and will sometimes possess accounting and/or technology capability.

- Professional accountants: Typically a CPA, professional accountants are equipped to make judgements around accounting rules and prepare reports like tax returns, financial statements, etc. CPA’s also have a degree of general business knowledge and the ability to interpret business finances.

- Tax professionals: CPA’s, EA’s, and others occupy this role and can vary significantly in their knowledge of the tax law, their experience working with business issues, their ability to do tax planning (versus just prepare returns), and other areas.

- Finance technologists: Someone with an understanding of technology and design who keeps pace with softwares and their evolving feature set, is able to spearhead rolling out solutions, knows how to integrate applications, and can answer questions whenever they pop up.

- Controllers: Typically a CPA, controllers are usually focused on identifying and applying accounting rules, designing and monitoring financial processes, and overseeing the numbers to make sure they’re complete and accurate.

- CFO’s: CFO’s focus more on the business financial strategy, helping run forecast analysis, evaluating the impact of decisions, integrating the business strategy with financial strategy, etc.

Assembling Your Business’ Finance Team

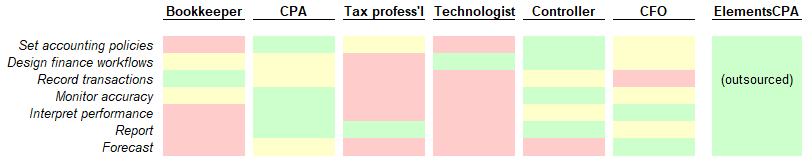

Different businesses at different stages will need different levels of sophistication in tasks and people. Putting the right mix together is about mapping your needs with the right people as illustrated in the handy chart below:

Your Business: Hamstrung or Trampolined?

A bad finance team can leave you overworked and your business’ future hampered – a situation that’s all too common for many entrepreneurs. But a good finance team can keep you energized and focused, freeing you up to build the future you envision and achieve the positive impact for your customers, team, and community.

To see if ElementsCPA is the right fit to be a part of your business finance team, just reach out for a chat!