Making sense of your company’s finances can be cumbersome, especially when further muddled by confusing accounting and tax rules. Instead, we believe good financial design should simplify, reveal, and enable. So with entrepreneurs in The Elements Circle, we apply a different way of looking at their business finances that we’ve distilled into our unique process called the Financial Design Method™.

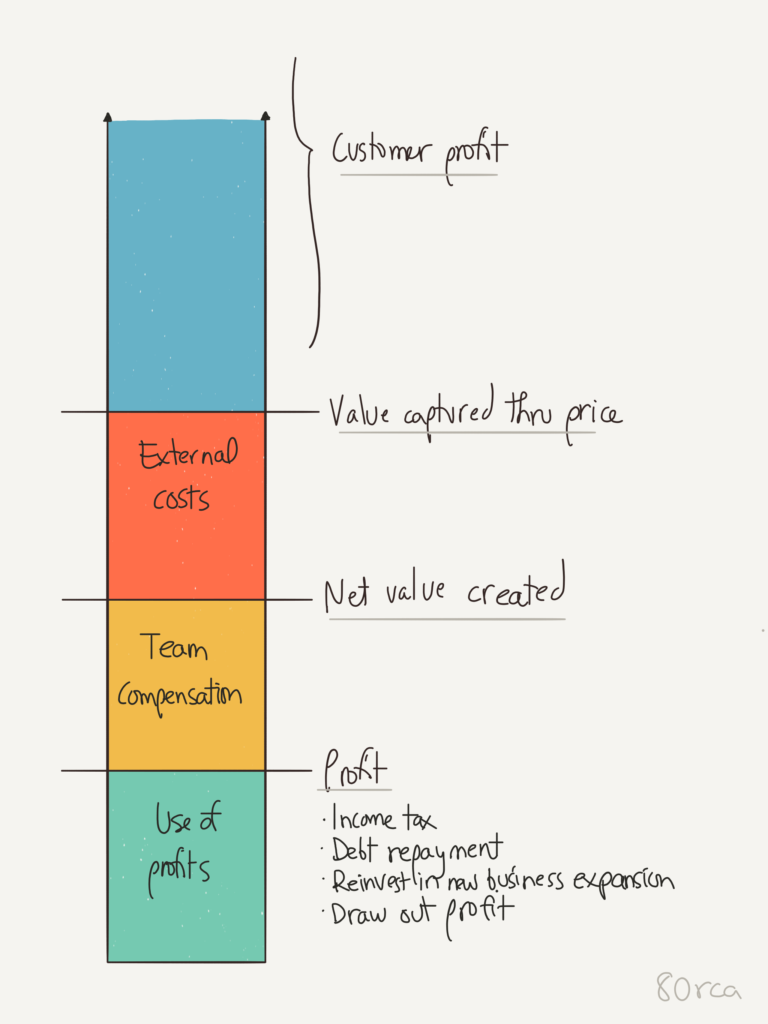

One of the core components of our method is the Value Bar – a way of visually representing the inflows and outflows of any business:

The Logic of the Value Bar

The Value Bar is all about how value is created and directed in the operation of every business. It follows the logic of:

- An entrepreneur designs a value exchange that enables all participants (customer, team, suppliers, and owners) to step away better than they came.

- A particular customer enters that value exchange and collaborates with the company to create value.

- The company retains some of that value through their price, and leaves the remaining value for the customer to enjoy (i.e., the “customer profit”).

- The company pays external suppliers for parts of the exchange that it decides it can’t/won’t create, leaving them better off (i.e., “supplier profit”).

- The remaining amount is the net value created by the company itself. It’s directed to the team members that help create it, leaving them better off (i.e., “team profit”).

- The final step is the business’ profit, which has four main uses: (a) paying tax, (b) paying debt, (c) re-investing back into the business, and (d) funding an owner profit draw.

Although it’s simple, the Value Bar makes it much easier to recognize important business concepts. For example, it illustrates that business profit is critical because it’s what fuels the reinvestment required to evolve the business model for the future.

Example Value Bar: Cybersecurity Company

So what does the Value Bar look like in practice? Let’s take a cybersecurity firm helping to secure and defend important government and commercial client networks:

- The entrepreneur defines the particular security products and services, assembles the team, and identifies the underlying technologies or services that will be bought from third parties.

- The firm then communicates its message to the marketplace, and a financial services firm reaches out and signs on.

- The cybersecurity firm immediately gets to work, evaluates the client’s network vulnerabilities, develops and deploys ways to harden the attack surface, and continuously monitors for anomalies.

- The firm’s price is much lower than the value of the change they effected for their financial services client, creating a secure network and peace-of-mind (the customer profit).

- In the process, the firm paid for certain software tools it didn’t want to develop in house, it paid for office space to enable team and client meetings, it paid a web design firm to launch a site that transmitted the firm’s message and identity, etc. (the supplier profit).

- The difference between the price and the amount paid to suppliers is the net value actually created by the firm itself. From this, the value is shared among the team members for their role in creating the value (team profit).

- From the business’ own profit, Uncle Sam and the state are paid their taxes, and a bank lender is repaid their startup loan. The entrepreneur sees additional growth potential for the firm, so she decides to retain the profits inside the firm to be able to finance new marketing efforts and to grow the talented team.

While we’ve used the example here of a cybersecurity firm, the same could be applied to an internet marketing firm, a strategy consulting company, a bio-tech software firm, and more.

The Power of the Value Bar

The power of the Value Bar is that it simplifies the evaluation of any company’s value creation process, and expresses it in a way that more accurately represents how business really works. Sadly, traditional accounting and tax don’t work this way, and so they obscure the ability of the entrepreneur to truly see how their business is doing, and make better decisions as a result. As we like to say: a tax return is designed to help the government know how much to tax you, and a financial statement is designed to help a bank evaluate creditworthiness, but the Value Bar helps the entrepreneur get the feedback on whether the financial hypothesis of their business model is actually working.

The Value Bar is just one part of our Financial Design Method™, and our Design Team is happy to step your business through this unique process so you too can benefit from finances that simplify, reveal, and enable your entrepreneurial journey.