The mathematical formula for making money is simple: Sales – Costs = Profits. The real-world reality is a little more complicated. But it need not be a mystery.

The mathematical formula for making money is simple: Sales – Costs = Profits. The real-world reality is a little more complicated. But it need not be a mystery.

This post is the second in a series about “making money”, delving into the basics of how business financials work. In the first, we looked at a few fundamentals of a business’ “cost structure”. And in this post, I want to talk about the important distinction for entrepreneurs between a “cost mentality”, and a “yield mentality”.

Mental models

Although we often don’t realize it, our way of interpreting the world is influenced by the mental frameworks we carry around in our heads. They’re usually accumulated over our life experiences, and they enable us to shortcut the decision making we’re constantly doing as we go about our day. A simple example is traffic patterns: from driving school and years of being on the road, we have an understanding of how cars and traffic flow. So much so, that we instinctively make turning and moving decisions as we wind our way from one place to another. But stick us in a foreign country, where those mental frameworks no longer apply, and we quickly realize all those embedded shortcuts are actually putting us in danger. (I once had this pointed out quite sharply while visiting New Zealand, where I nearly got myself run over crossing the street.)

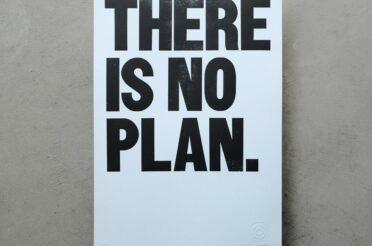

The same is true in business: we have mental frameworks that are shaping our decisions as we go about our work. And some of them can be sub-optimal, or even harmful, without us realizing it. I suggest one of these, is the “cost mentality”: many small business owners look at “Costs” in the profit equation, and think the goal is to make them as small as possible. At first glance, this seems to make sense: after all, the math suggests if I lower my costs, I increase my profits. But math truisms, aren’t business truisms: there’s actually an invisible link between Costs and Sales.

Cost versus Yield

What do I mean? Let’s say I want a new pair of shoes — I go to the store, and in front of me is a $25 pair of kicks, and a $75 pair. If I apply a cost mentality, I’ll simply go for the $25 pair and say to myself, ‘Why should I pay any more? I just saved a very real $50, and increased my personal profit.’ But perhaps that $25 pair is made of less durable materials, and the construction weak, so that after four months my feet are starting to hurt and the shoes are falling apart. I go back to the store, follow the same analysis, and get another $25 pair, and go through the same cycle again. After a year, I’ve paid $75 anyways and maybe more, not to mention the lost time, mental effort, and travel cost of going back and forth to the store. The “cost mentality” was sub-optimal.

Instead, a better way to think about purchase decisions is the “yield mentality”: rather than trying to minimize cost, maximize yield. So if one price is $2 and the other is $5, take it one step further and ask: what does each purchase yield? Perhaps you can turn a $2 purchase into a $4 sale (a $2 profit), but you can turn the $5 purchase into an $11 sale (a $6 profit). In the end, the cheaper purchase actually cost you more — it cost $4 in lost opportunity profit.

True entrepreneurial math

This is the mind of true entrepreneurism: how can you take the resources at your disposal, and put them to their highest and best use for those around you? Where are the unserved areas of value, that would make the biggest impact for people? It involves less of a focus on cost, and more of a focus on the yield it can lead to.

In the end, the true math of the profit equation isn’t subtraction, it’s multiplication.

(By the way, this is why we partner with entrepreneurs who see our relationship as an investment, not a cost — because our mission is to multiply our price into progress in the areas important to you, not minimize the amount we can do for you. If you’re one of the former, we’d love to talk.)